Talk about the great leveler, and AI seems to be ranking just after death. Artificial Intelligence is today leveling the playing field between the Davids and the Goliaths in the world of investment banking - a trend that is only set to grow in multiples as we transform into a “AI-based decision making” world in this jet setting and lucrative industry.

For a phenomenon that’s sweeping the world of investment banking, AI has become more than just a buzzword. According to Gartner, AI will generate more than $2.9 trillion in business value and recover 6.2 billion hours of worker productivity by 2021. Forrester Research also predicts that AI-driven companies will take away a staggering $1.2 trillion away from their non-AI capable counterparts by 2020.

A simple definition of the technology can be stated as “AI comprises systems that are able to perform tasks that otherwise need human intelligence”. A large component is machine learning, which uses past data to predict the future and deep learning - a specialized subdomain of machine learning that uses multi-layer neural networks to imitate the mechanisms of the human brain in processing data and using them in accurate and timely decision making. These three concepts are the most widespread in the use of investment banking functions across the world today.

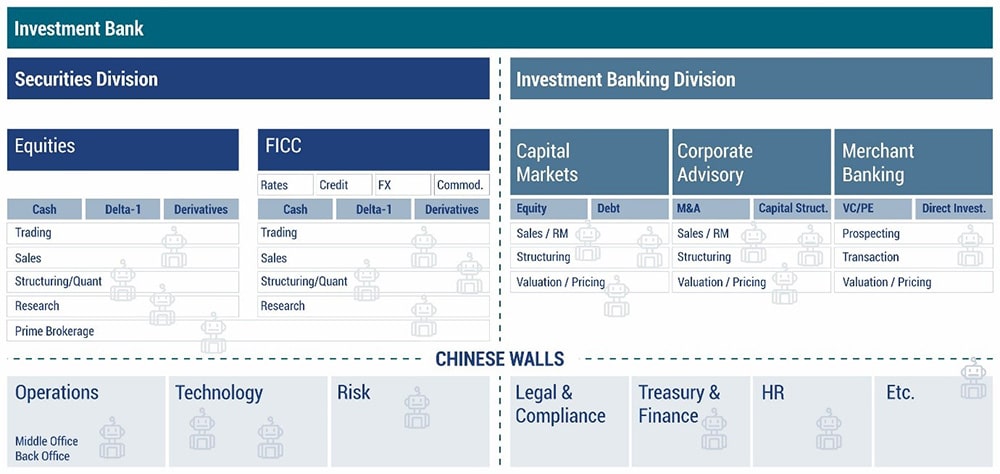

In the world of high stakes investment banking, AI can be deployed in an investment bank's securities division, in both their equity trading desks and fixed income clearing corporation functions, while also greatly enhancing the performances and accuracies in the core investment banking divisions that include capital markets, corporate and institutional advisory products and services, not to mention merchant banking.

Functions that can be completely synchronized to facilitate AI recommended decision making by humans in investment banking include sub-departments within those functions, for example, back-office operations, technology operations, risk management operations, legal and compliance functions, treasury and finance operations, human resources and a whole lot more, exemplified by the graph below:

Department Wise Use Cases of AI in A Generic Investment Banking Setup

There have been several implementations of AI across the broad spectrum of investment banking already, and the rapid pace of adoption paves the way for greater efficiencies in almost all departments and functions. It has been rightly said that AI has the potential to completely transform the competitive dynamics given its indispensability in investment banking. Much like a chain reaction, investment banks will adopt AI if even one of their peers adopts it, and they already have. This will keep going until all of them rely on the accuracy and effectiveness of AI in their daily trade and investment making decisions. By its very nature, investment banking is a highly competitive industry, and intelligent tools can augment every facet from trade processing to defining structure products and projecting returns on capital, simulating market conditions to support accurate and fast decision making, to even enhancing the customer experience. AI will also greatly enhance back-office functions, ensuring quicker andeasier settlements with minimal human error.

AI Potential in Investment Banking

To talk about Artificial Intelligence in banking warrants a small coverage, at least, of some use cases where it is already in practice:

ING - ING leverages the power of AI to empower bond traders make faster and more accurate pricing decisions, with Katana, an AI tool that uses predictive analytics to ensure traders are quoting the right price when buying and selling bonds for their clients, based entirely on historic and real-time streaming data

Barclay’s - The UK investment bank takes its AI initiatives very seriously, with the whole subsidiary dedicated to making the investment bank’s vision of becoming “the most AI savvy workforce in the UK” come true. Payments and trade decisions for their short term structured products are handled by their in-house AI.

UBS - UBS uses machine learning and neural networks for facilitating accurate decision making of its traders on the floor, including the allocation of funds and analyzing real time data to enhance the performance of its high performing traders.

JP Morgan Chase - The American investment banking giant is using AI to interpret loan agreements. As a part of its AI agenda, it’s now famous Contract Intelligence AI system saved 360,000 hours of mundane work, interpreting and recording contract clauses, freeing up support staff to focus on high value delivery.

….AI is actually creating more jobs than it is replacing. But most importantly, the use of artificial intelligence as the new normal in investment banking worldwide. According to the professional network LinkedIn, AI jobs saw an increase of 190% between 2015 and 2017. Even higher is the demand of investment banking professionals who are technologically savvy to incorporate AI in their daily operations across departments, with several initiatives with academia already underway by the likes of Barclays and JP Morgan Chase to enhance their AI adoption at even faster rates.

Artificial intelligence has already become a game-changer in investment banking, and the industry is thirsting for AI savvy investment bankers with the tech wherewithal to make it big. The stakes are even higher and reserved for the select few and a paycheck is not limited by budgets for the certified, proficient investment banking professional looking to make their mark in the industry. So step up your game in investment banking with world-class, advanced professional certifications for the job, the lifestyle, and the paycheck you’ve always dreamt of. The time is now.

Investment Banking Salary Guide

Investment Banking Salary Guide

Discounted Cash Flow Analysis: Formula, Use, Types & Benefits

Discounted Cash Flow Analysis: Formula, Use, Types & Benefits

Decarbonization: The Path to a Cleaner, Greener Future

Decarbonization: The Path to a Cleaner, Greener Future