The IBANX™ framework of the Investment Banking Council of America (IBCA) addresses a significant void that investment banks have encountered since the industry's inception following the initial oil shock. This void emerged due to the lack of a unified global standard for knowledge among investment bankers worldwide. Today, IBCA is at the forefront of innovation, introducing models, standards, systems, and practices to validate and accredit excellence across the entire spectrum of traditional and emerging investment banking professions.

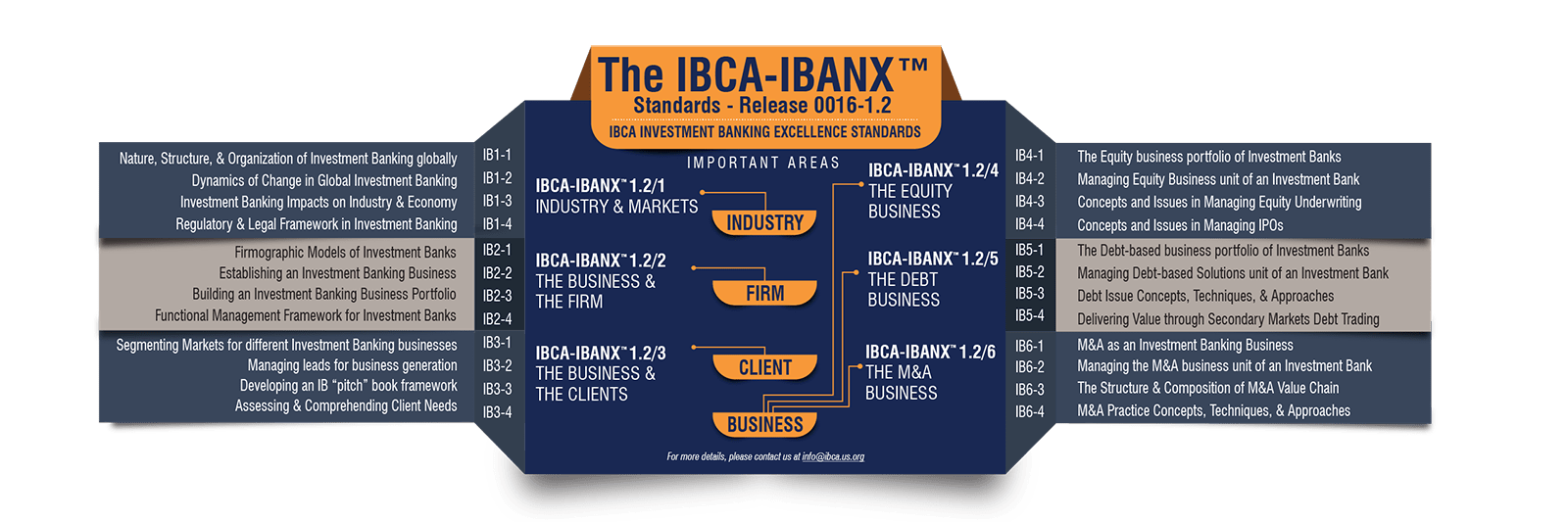

The IBCA-IBANX™ standards outline the areas in which finance and investment professionals require critical comprehension and proficiency to elevate their expertise in investment banking. IBCA stands as the world's first and only body for credentialing and standards that places substantial emphasis on the market and firmographic dimensions of Investment Banking. This extends the realm of professional wisdom beyond mere mathematical valuation models and analytics. The IBANX™ Investment Banking Standards model is, without doubt, the world's most advanced of its kind, catering to finance, investment, and accounting professionals seeking to build and substantiate their competence in Investment Banking, particularly within complex practice contexts and environments.

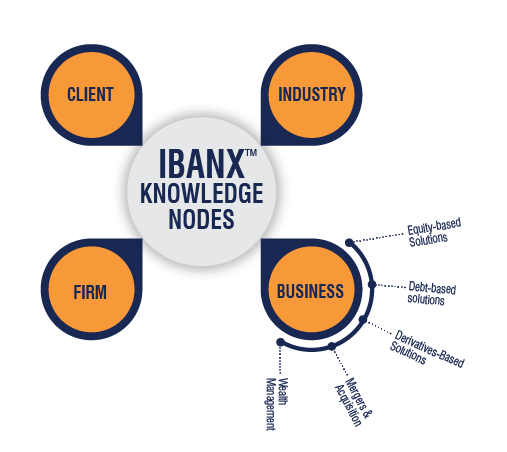

The IBCA Investment Banking Excellence (IBANX™) model delineates knowledge standards across four fundamental realms of Investment Banking for professionals engaged in, or preparing for assignments and roles demanding the study, design, and execution of decisions related to capital raising from debt or equity markets for client companies. It also covers those involved in acquiring or merging companies, devising innovative financing solutions using derivatives, and making decisions aimed at enhancing the wealth of high-net-worth individuals. The CIBP™ qualification is aligned with exams based on the IBANX™ framework, which defines 60 distinct areas essential for Investment Banking practitioners to excel in.

The IBCA's body of knowledge that underpins CIBP™ credentialing and general investment banking practice excellence revolves around the IBANX™ framework. Referred to as the IBANX™ body of knowledge, it outlines the structure, content, and policies of the CIBP™ exam.

The IBANX™ grid encompasses 60 focal themes of critical attention and learning, distributed among the four core segments of investment banking knowledge. This division makes it highly convenient for recruitment teams in investment banks to discern the specific knowledge they should seek in job applicants. This precise alignment is why the IBANX™-based CIBP™ becomes a remarkably effective tool for organizations in recruitment and decision-making related to mobility. The learning resources for CIBP™ have been meticulously crafted to adhere to the stipulations of the IBANX™ framework.

Explore