Introduction

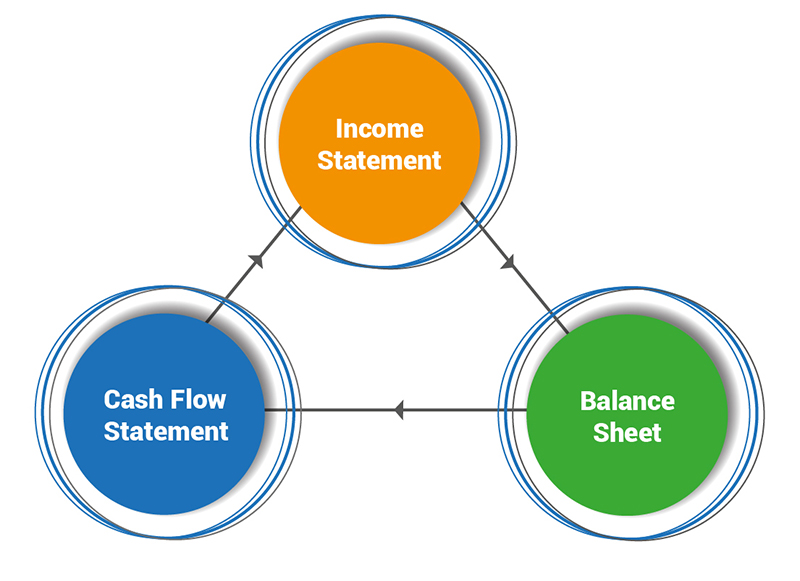

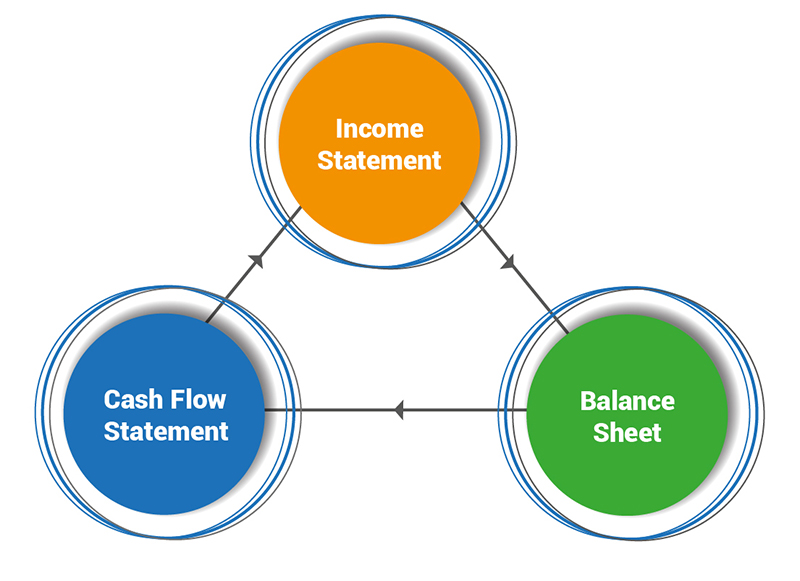

Evaluating business performance and predicting future outcomes and decision-making in corporate finance heavily relies on financial modeling. Financial modeling primarily depends on integrating 3 financial statements in a cohesive model structure better known as the 3-Statement Financial Model.

A comprehensive 3-statement model provides professionals with tools to measure profitability alongside liquidity and financial stability. The widespread use of this model in investment banking, private equity, and corporate finance demands comprehensive mastery because it delivers precise financial projections and strategic planning.

Core Components of the 3-Statement Financial Model

The 3-statement financial model integrates three financial documents, collectively generating a comprehensive assessment of organizational financial status. This financial model uses interrelated statements for specific analytic purposes that improves forecast accuracy.

-

Income Statement: A company demonstrates its profit achievement through these statements for designated timeframes. Operating performance, revenues, cost of goods sold (COGS), expenses, interest expenses, taxes, and net income form the structure of this financial model. A company's operating performance and financial strength become measurable through key metrics generated from this statement, such as gross profit, operating profit, and net profit.

-

Balance Sheet: A balance sheet is a snapshot of how a business looks at a particular point in time, documenting the balance between a company’s assets, liabilities, and ownership equity. It means that the company will either finance its assets through equity or debt. Key elements include:

- Current and Non-Current assets (Cash, receivables, property)

- Liabilities (e.g., short-term debt, long-term obligations)

- Shareholder’s equity (capital invested, retained earnings)

Cash Flow Statement: This statement records the cash flow based on the following classifications:

- Operating Activities: The funds produced by ordinary operating activities that uplift and sustain the primary operations of an organization.

- Investing Activities: Capital expenditures and asset purchases or sales.

- Financing Activities: Debt issuance, repayments, and dividend distributions.

What is Periodicity in 3-Statement Modeling?

The first crucial step when building a 3-statement financial model is determining which periodicity the model will utilize. The model's authorization spans from yearly to quarterly to monthly to weekly timeframes. The period choice for a 3-statement financial model emerges from its defined purpose.

Below are some general rules of thumb:

-

Annual Models: The model finds regular usage when building DCF valuation forecasts. A DCF analysis requires five years of explicit forecasts to calculate terminal value. Many LBO models operate on annual forecast periods since the average investment duration stands at approximately 5 years. One interesting aspect of annual models involves handling the stub period incorporating the most recent sequencing of 3, 6, or 9-month historical data

-

Quarterly Financial Models: Equity research alongside credit analysis and financial planning and analysis along with mergers and acquisitions (accretion/dilution) models use short-term issues as catalysts that demand quarterly financial models. The economic models typically build up to the final annual estimate.

-

Monthly Financial Models: Project finance alongside restructuring requires ongoing assessments of monthly liquidity since project monitoring relies heavily on fluidity tracking. The compilation of monthly financial models requires data inputs which management generally does not disclose to external stakeholders beyond private communications. The monthly financial models tend to accumulate into quarterly summaries.

-

Weekly Financial Models: Common in bankruptcies; the thirteen-week cash flow model (TWCF) represents the most frequently used weekly financial model. A bankruptcy process mandates TWCF as a necessary track for both cash and liquid assets.

Essential Principles to Understand Before Constructing the Model

A deep understanding of fundamental financial concepts is essential before constructing a 3-statement financial model. These principles build essential structures that make the model operate seamlessly as one integrated system.

Critical Functions of DCM in Investment Banking:

-

Understanding Financial Linkages: The three financial statements interact with one another through their business connection points. Financial inputs create linked effects across multiple statements, so it is vital to develop strong relationships between revenue and expenses and between assets and liabilities with changes in cash flow.

-

Historical Data and Assumptions: Reliable historical data is the foundation for predicting upcoming operational outcomes. Revenue growth projection strategies, cost structure capital expenditure, and working capital management plans must rely on actual marketplace benchmarks and reasonable business projections.

-

Standardized Inputs and Outputs: The prevention of errors and a better understanding of the model results from maintaining consistent data entry methods, formatting standards, and mathematical computations across the system. A transparent output appears through a clear separation of fundamental assumptions from calculation processes.

-

Logical Flow and Structure: A structured financial model uses a systematic structure that starts with revenue forecasting and proceeds through cost details; followed by adjustments to assets and liabilities and cash flow modification. This methodology organizes financial performance data.

Step-by-Step Guide to Constructing a Comprehensive 3-Statement Financial Model

A 3-statement financial model demands a systematic building process for accuracy and integrity. The following breakdown provides a detailed overview of each fundamental step needed to build a reliable model.

1. Data Collection and Assumption Setup

Establishing a well-defined financial model begins by collecting historical financial data and creating exact assumptions. This step involves:

-

The analysis determines the primary revenue sources while studying expenses and scheduled projects for capital outlay.

-

Realistic projections result from analyzing historical financial data.

-

Business performance depends on macroeconomic elements and factors unique to specific industries.

2. Constructing the Income Statement

Profits in the income statement serve as the starting point for all related financial documents. this process includes:

-

The estimated revenue projection incorporates historical growth patterns together with market situation analysis.

-

Preparing cost of goods sold (COGS) and operating expense estimates.

-

The financial statements must reflect records for depreciation expenses, interest debt, and tax deductions.

-

The net income computation follows into the balance sheet's retained earnings portion.

3. Linking to the Balance Sheet

Financial stability depends on the balance sheet, which tracks assets and liabilities with equity information. This includes:

-

The financial forecast appraises present-day and future-oriented assets using capital spending and depreciation calculations.

-

The analysis predicts adjustments related to accounts receivable, inventory movement, and accounts payable dynamics.

-

The financial statement incorporates debt payment schedules that update liability accounting.

-

Users apply net income from the income statement while adjusting retained earnings.

4. Creating the Cash Flow Statement

A well-constructed cash flow analysis maintains a stable state of liquidity. The key components are:

-

Cash Flow from Operations: Moving from net income, this statement adds adjustments for non-cash expenses and working capital changes.

-

Cash Flow from Investing: This section includes capital expenditure and asset disposals.

-

Cash Flow from Financing: A company reports debt, equity, and dividend distribution modification through this statement.

5. Establishing Formula-Driven Linkages

To create a dynamic and responsive 3-statement model, ensure the following:

-

The model features instant statement updates through connected key formula relationships.

-

A system of automated processes protects financial accuracy through continuous balance maintenance.

-

Financial risk assessment and estimation of future uncertainties are evaluated through sensitivity analysis.

Ensuring Accuracy and Reliability in a 3-Statement Financial Model

A 3-statement financial model demands complete accuracy and reliability to facilitate business decisions. Doubtful assumptions linked with incorrect data connections and irregular data responses lead to distorted business strategy directions. Financial analysts follow established best practices to improve model accuracy, efficiency, and reliability.

Key Practices to Improve Model Accuracy:

-

Validate Inputs and Assumptions: Financial models need three fundamental assumptions that include, revenue projections, operating expense management, and capital allocation plans. any mistake in either of these assumptions will make future forecasts inaccurate.

For instance, if a company overestimates revenue growth without considering market trends, it may miscalculate future cash flows and lead to poor investment decisions.

-

Perform Sensitivity Analysis: Businesses require testing multiple potential scenarios because they deal with unpredictable market environments.

For example, if a company’s operating costs rise by 5% due to inflation, sensitivity analysis helps predict its impact on profitability and liquidity.

-

Ensure Dynamic Formula-Driven Linkages: The 3-statement model requires full integration to create accurate financial statement interconnections. An adjustment entry to depreciation in the income statement triggers automated updates that affect both the balance sheet and the cash flow statement.

-

Reconcile Statements to Maintain Consistency: A well-built model ensures the balance sheet balances (Assets = Liabilities + Equity). Financial linkage inconsistency between statements highlights errors in linked formulas and missing cash flow adjustments.

Strategic Applications of the 3-Statement Financial Model in Business Decision-Making

The 3-statement financial model is a fundamental business instrument that helps organizations analyze financial results, forecast upcoming patterns, and make strategic planning decisions. The simultaneous use of income statements, balance sheets, and cash flow statements provides companies with complete financial visibility, enabling them to make strategic choices regarding growth investments and risk control.

Here are some of the key applications:

-

Strategic Planning and Forecasting: Companies employ the 3-statement model for revenue forecasting, expense analysis, and cash flow projection to align financial outcomes with ultimate business targets. The model enables analysis of different scenarios, stress testing, and assessment of strategic measures of economic effects.

-

Valuation and Fundraising: This mode is responsible for a company's valuation profitability measure based on understanding its capital structure. Investors and financial analysts consistently use this mode for assessment. The modeling technique assists startup enterprises and existing organizations in attracting investors by revealing financial stability and foreseeable expansion growth.

-

Mergers and Acquisitions (M&A) Analysis: Organizations use this model to assess merger opportunities by evaluating budgetary benefits, capacity for additional debt, and the performance of merged operations. The model enables teams to develop investment proposals while determining which transactions are financially feasible.

-

Financial Risk Management: Financial stability evaluation and liquidity assessment enable businesses to recognize potential risks , allocate capital efficiently, and create response strategies to prevent declines or market changes.

Conclusion

Professionals need to master the 3-statement financial model completely to understand financial results and direct organizational strategy. This step-by-step methodology will help businesses acquire exact information about profitability, liquidity, and overall financial wellness. The model is essential for predictive modeling, valuation activities, and investment assessment. It drives business growth by maximizing resource effectiveness and securing extended-term business success. Financial leaders across every industry need to master these crucial techniques.