Introduction

An investment banking associate is a key player in the world of investment banking and acts as a bridge between junior analysts and senior bankers. The associates, therefore, are in charge of the operational aspects of executing major financial transactions such as mergers, acquisitions, and capital market transactions. This makes them have a good understanding of finance, clients, and deals, which makes them very vital in the investment banking sector. To get a job in this exciting industry, one has to know the duties and the career progression of an associate in this area of investment banking.

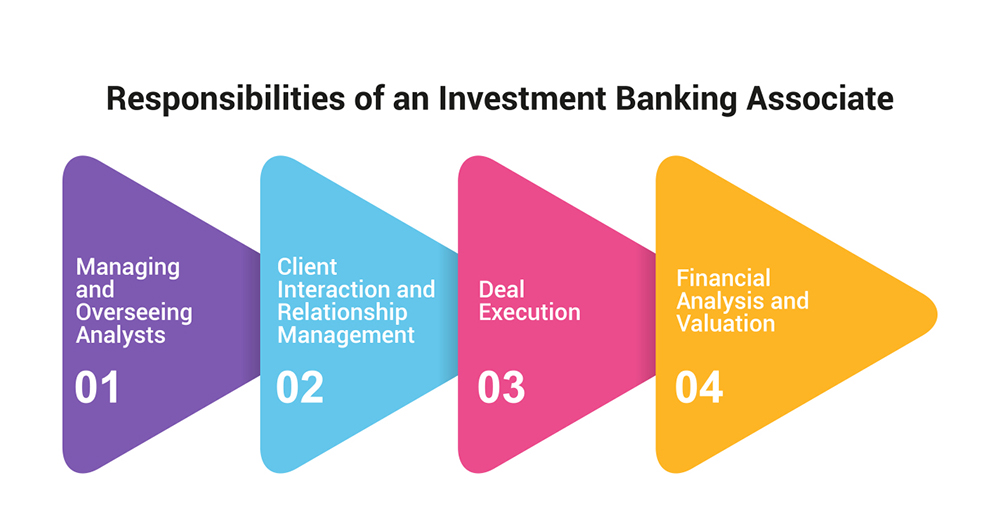

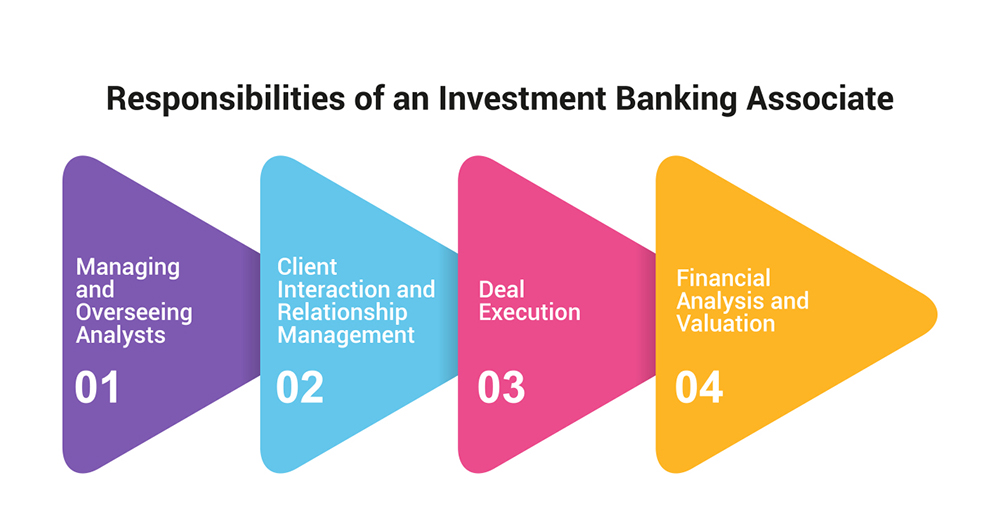

Core Responsibilities of an Investment Banking Associate

An investment banking associate is a valuable part of the team and contributes to achieving the objectives of deals and clients. The position involves managerial, problem-solving, and interpersonal skills because associates act as the central point of contact between analysts and senior bankers. Below are the key responsibilities that define this role:

-

Managing and Overseeing Analysts: The associates are required to oversee the performance of the analysts and to review all financial models, reports, and presentations prepared by them to ensure that they are correct and at par with the company standards. They help analysts perfect their work, give comments, and control the time.

-

Client Interaction and Relationship Management: Being the first point of contact with clients, associates are responsible for the enhancement of client relationships. They talk to clients regularly, respond to questions, and set client expectations as regards the services of the firm.

-

Deal Execution: Associates are quite participative in the deal-making process, starting from the pre-deal phase up to the post-deal phase. They ensure that due diligence processes are carried out, engaging other people to get the relevant information. Also, they design pitch books and assist in the structuring of transactions, which are carried out with great precision.

-

Financial Analysis and Valuations: Supervising and performing financial analyses is one of the main tasks. Associates also check and optimize advanced financial models, calculate the worth of certain companies or projects, and provide forecasts useful for management. Their analytical work is very useful when senior bankers are involved in the negotiations and meetings with the clients.

In essence, the job of an investment banking associate is complex, as one has to be technically sound, manage resources, and deal with clients. This makes the associates central in the fostering of the success of investment banking operations.

Skills Required to Become an Investment Banking Associate

To be successful in the position of investment banking associate, both technical and interpersonal skills are useful. Let’s delve into the key competencies that can set you apart in this demanding role:

-

Analytical and Quantitative Skills: There is no way around understanding financial data and the capability to analyze it deeply. Some of the investment banking skills you are expected to possess include financial modeling, valuation, and data analysis.

-

Leadership and Team Management: In the position of an associate, you may manage analysts and collaborate with different departments. Good leadership skills enable you to plan for the workload, train other employees, and see to it that deadlines are met.

-

Client Management and Communication: It is important to communicate with clients daily, which requires one to explain financial issues in simple language while expecting to build and sustain good relationships with clients.

-

Time Management and Multitasking: It requires managing different projects at the same time. This means that how well you will be able to arrange your tasks, plan how you will use your time, and arrange yourself will be essential.

How to Get into Investment Banking

To embark on investment banking, a specific path of education, working experience, and connection should be followed. Here's how you can get into investment banking successfully:

-

Educational Background: First, you should get a bachelor’s degree in finance, economics, or a related subject. Additionally getting an MBA from a good business school is also beneficial; it gives both knowledge and contact information.

-

Relevant Experience: Almost all the associates join the firm as analysts, and they are exposed to the practical aspects of financial modeling, valuation, and deal-making. The internships that can be taken during the undergraduate or MBA program are quite valuable as they provide real-world experience and a way into the company.

-

Certification: Obtaining certifications such as the CIBP™ (Chartered Investment Banking Professional) can help you stand out from other applicants. Such credentials prove your passion and experience within the subject to which you are applying.

-

Networking and Mentorship: Relationships are as important in the investment banking industry as they are in any other industry. It is recommended to attend industry events, join finance clubs, and try to find a mentor who can help you and possibly get you into the industry. Networking is not the number of people who you know, but the number of people who know you and your skills.

These areas will help you map out a clear strategy on how to become an investment banking associate and grow in this highly competitive industry.

Investment Banking Salary and Compensation Structure

As an investment banking associate, it is important to know the details of the salary and compensation. Remuneration in this position is good as a result of the strenuous responsibilities that associates must undertake in their firms.

-

Base Salary: The base salary of an investment banking associate is usually between USD 125,000 and USD 200,000 per year based on the firm, location, and personal performance.

-

Performance-Based Bonuses: Bonuses form a significant part of an associate’s remuneration and are based on individual and firm performance. These bonuses can be from 50% to 100% of the base salary or even more if the case is exceptional.

-

Long-Term Incentives: There are other benefits that the associates can get in the future, such as stock options, profit sharing, or deferred compensation plans, aside from the basic salary and bonuses. These incentives bear the potential of linking the associate’s compensation to the long-term performance of the company and, consequently, boosting the overall remuneration.

It is also important to realize that compensation can differ significantly between firms, with the bigger banks often providing more attractive deals. However, the workload and pressure are common, and anyone interested in pursuing this career should carefully consider these factors.

Conclusion

The job of an investment banking associate is crucial in the realization of deals, relationship management with the clients, and supervision of the analysts. This position is a paradox of responsibility and opportunity, making it an important bridge to more senior positions in the field. It is therefore possible for aspirants to find their way into this challenging but highly rewarding profession through a proper combination of education, experience, and networking. It’s for this reason that the position of an investment banking associate is one of the most exciting and well-paying jobs in the world of finance, given that you are at the center of major financial operations.