Introduction

The functions of investment banking are about to change due to the latest innovation in artificial intelligence (AI). Investment banking is also not an exception when it comes to the application of AI, which is transforming the industry in terms of productivity, precision, and creativity. These advancements include generative AI in finance, which provides enhanced features such as data analysis, predictive modeling, and automation. This article aims to outline how generative AI is changing investment banking, the effects it has, and the potential it offers for further evolution within the financial industry.

The Evolution of AI in Investment Banking

The integration of AI in investment banking has been a process that can be characterized by several stages and developments. In the beginning, AI was applied to perform repetitive actions and improve the speed of data analysis. It has evolved over the years and has been used in many areas of the industry in various innovative ways.

-

Early Adoption: The first stage involved the application of AI in data analytics and back-end processes to minimize paperwork and enhance productivity.

-

Algorithmic Trading: The utilization of algorithms that are AI-based in trading changed the way people analyze the market and come up with strategies to trade.

-

Risk Management: AI models were adopted in risk assessment to deliver intricate ways of analyzing risks and preventing them.

With the progression of AI, generative AI came into existence and presented new opportunities for creation. The use of generative AI in the creation of models and the simulation of market conditions has helped to increase the strategic proficiency of investment banks. Generative AI in finance is the latest trend of technological advancement that has revolutionized the investment banking business by increasing efficiency and accuracy and enhancing the level of personalization.

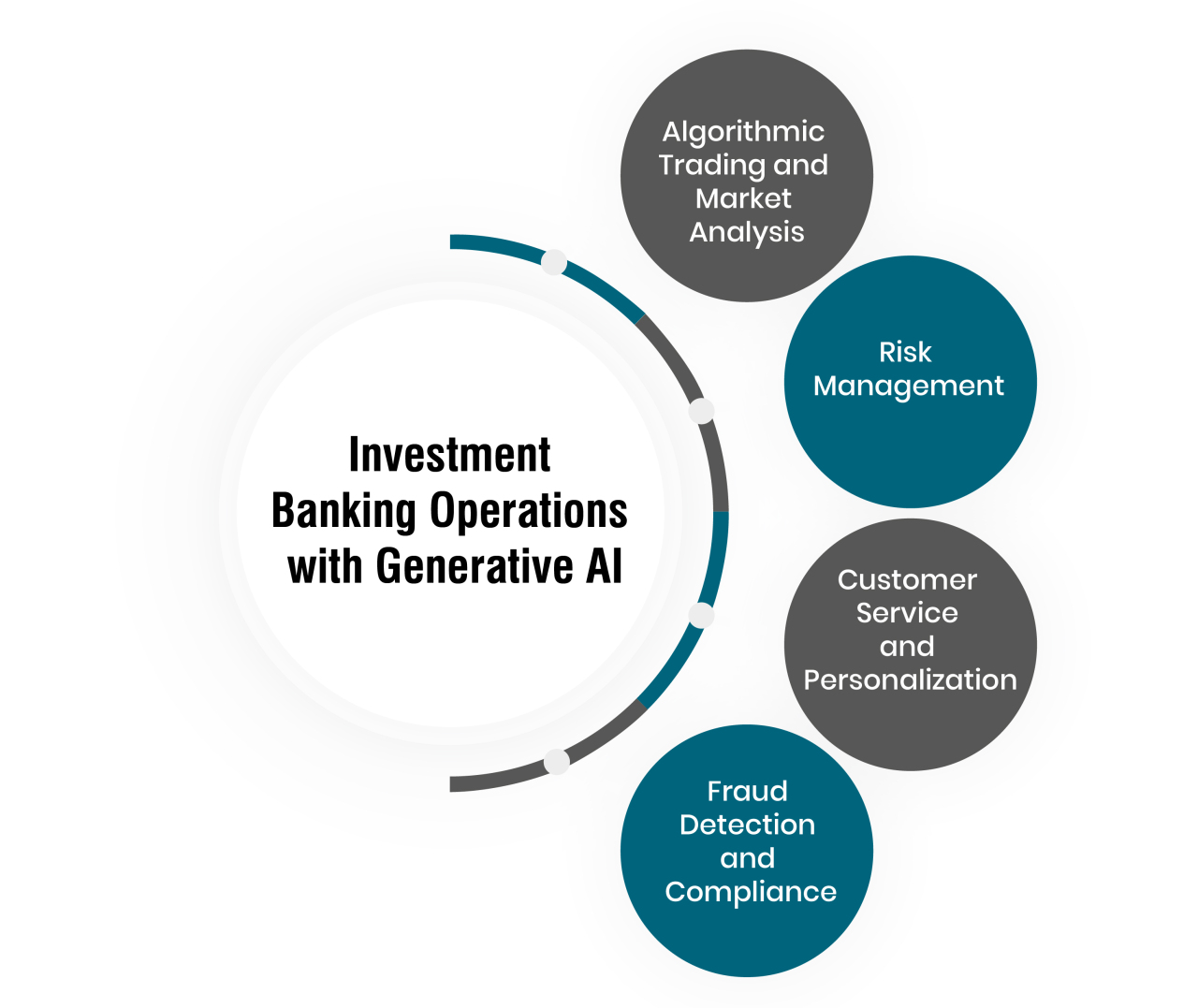

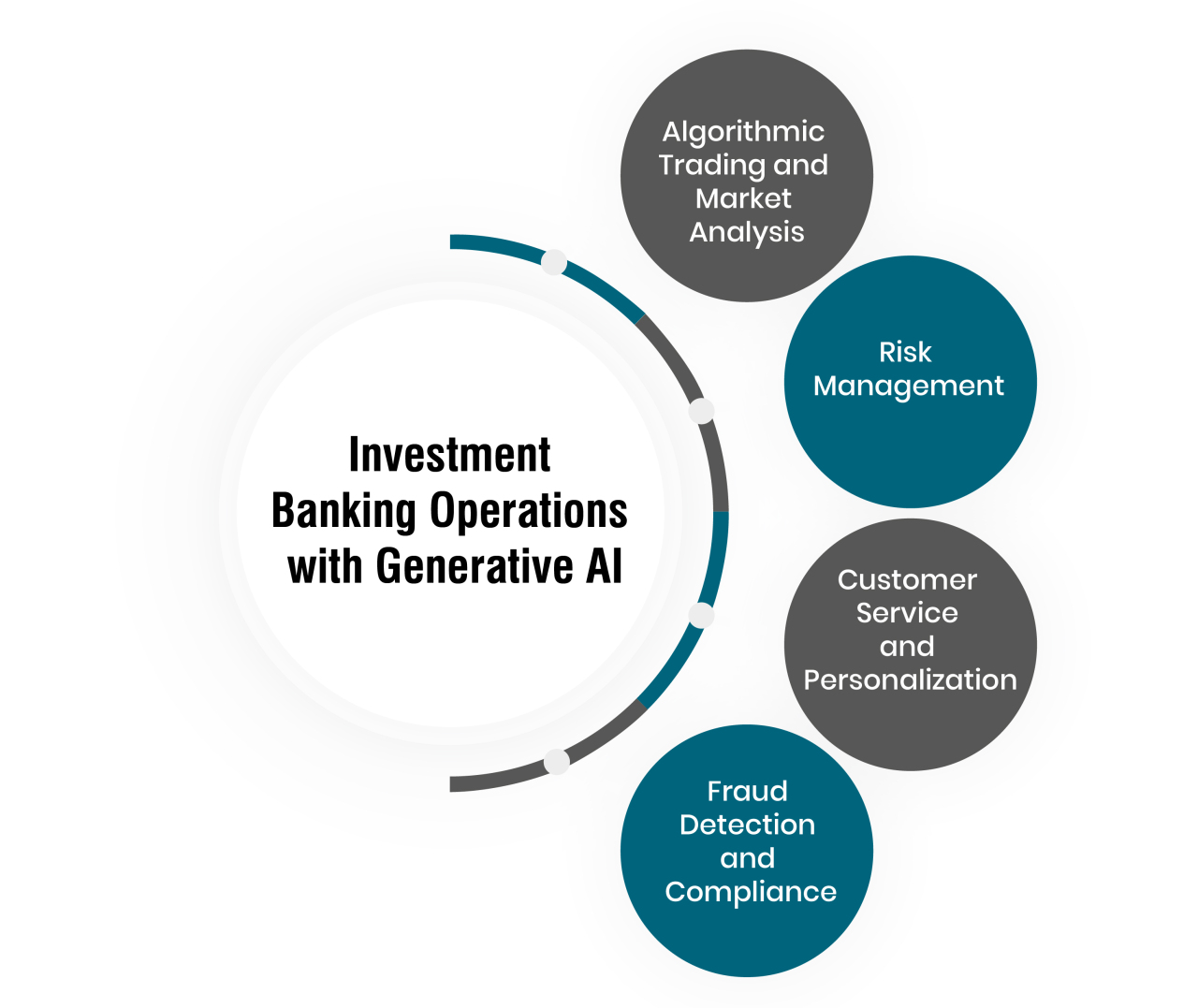

How Generative AI is Revolutionizing Investment Banking Operations

AI-generative models are rapidly transforming investment banking by creating sophisticated tools that can improve many functions across the business. These benefits of generative AI in finance include better predictions, enhanced decision-making, and higher productivity at work. Here are some key applications:

-

Algorithmic Trading and Market Analysis: Generative AI can easily process a lot of market data to create an effective trading plan. Through machine learning algorithms, investment banks can better anticipate market movements and manage their trades. This minimizes their dependence on conventional methods and assists firms in coping with the dynamic market environment.

-

Risk Management: Artificial intelligence models help in managing risks as they can forecast financial risks and assess risks more effectively. Generative AI can create many possible economic environments and their effects on portfolios, thus helping banks in their efforts to minimize risks. Such an approach is useful in reducing losses, managing risks and uncertainties better.

-

Customer Service and Personalization: Implementing AI improves relations between a company and its customers by offering individualized recommendations and assistance. AI chatbots and virtual assistants are useful in answering clients’ questions, providing financial advice, and processing transactions. This results in a better client experience and, therefore, enhanced satisfaction through the provision of solutions to the particular needs of the client.

-

Fraud Detection and Compliance: Generative AI is used in the prevention of fraud and fulfilling legal requirements. Based on the analysis of the transactions and the detection of anomalies, AI systems can mark suspicious activities in real-time. This also enhances the organization’s security measures and, at the same time, implements regulatory compliance, thereby avoiding legal problems.

These applications demonstrate the possibility of AI in investment banking. Thus, the use of generative AI allows banks to optimize their operations, increase accuracy, and provide better customer service to become market leaders in innovation within the financial sector.

Case Studies of Generative AI in Finance

Generative AI has been employed in various areas of finance, and its efficacy has been seen in real-life use cases.

-

Example 1: AI-Enhanced Portfolio Management at Goldman Sachs

Goldman Sachs uses generative AI to extend the firm’s portfolio management capabilities. By using AI technologies, the company has enhanced its ability to predict risk and returns, thereby making better decisions on asset allocation and risk management. It thus makes it possible to construct efficient portfolios that address specific client requirements and, consequently, improve returns.

-

Example 2: Automated Trading Systems at JPMorgan Chase

JPMorgan Chase relies on generative AI in its computer algorithms for trading. The technology is designed to process large amounts of data to spot trends and develop models for how to trade. This integration of AI in trading has made operations more effective, faster, and consistent with market trends, thus improving profitability and competitiveness.

-

Example 3: AI in Compliance at HSBC

The use of generative AI has been deployed in the compliance processes of HSBC. Real-time anomaly identification and potential compliance risk are also flagged by the AI systems, which greatly minimizes the time spent on compliance checks. This application helps in the proper monitoring of compliance, and also prevents any financial crime as well as the payment of regulatory fines.

These above cases demonstrate how generative AI has become transformative in finance and how it is helping to revolutionize the field.

Advantages of Integrating Generative AI into Investment Banking Operations

Several advantages of applying generative AI in investment banking can lead to improved operations. Firstly, generative AI increases efficiency by executing mundane tasks and improving intricate operations, thus cutting costs and boosting output. This technology is useful in enhancing the accuracy of the analytics used in making decisions; hence, the management of investment risks becomes more efficient.

Secondly, generative AI also enhances the quality of the client experience by providing customized services and adjusting the interaction according to the data analysis. It enhances the ability to detect fraud and be compliant and has features that enable real-time monitoring and anomaly detection.

Key benefits include:

-

Better management through technology in operations.

-

Improved decision-making because of accurate statistical analysis for the forecast.

-

Individual approach to the clients and individual solutions.

-

Enhanced fraud prevention and compliance monitoring.

These benefits depict how generative AI is transforming the face of AI in finance, coming up with new ideas, and even setting new benchmarks for the sector.

Emerging Trends and Future Directions in Generative AI for Investment Banking

As AI in investment banking continues to evolve, several key trends are shaping the future of the industry:

-

Advanced Predictive Analytics: AI models that are generative will improve the predictive models and offer better and more reliable results and trends in the markets. This will assist the banks in better decision-making, hence improving the risk management of the investments.

-

Enhanced Personalization: As technology evolves, it is expected to get even better in the sense that financial solutions and services will be tailored to each client’s specifications.

-

Integration with Quantum Computing: Quantitative finance will be transformed by the coupling of generative AI with quantum computing, providing high-speed and accurate data processing.

-

Improved Regulatory Compliance: AI will continue to aid in managing regulations and compliance, as well as ensure that organizations meet their financial compliance requirements.

The above trends suggest that we are likely to see generative AI in finance play an even more significant role in investment banking operations in the future.

Conclusion

The use of generative AI in finance is expected to revolutionize investment banking by improving its effectiveness and accuracy. Applying AI in investment banking is beneficial for increasing the effectiveness of decisions, improving the efficiency of processes, and increasing the level of customer service. It is important to adopt these technologies to remain relevant and to effectively manage the financial industry of the future.