Introduction

Debt capital markets (DCM) are crucial in every global financial system, where corporations, governments, and other institutions borrow funds through debt securities. The DCM is a cornerstone of debt capital markets investment banking and encourages selective capital allocation as it presents investors with stable returns. It promotes economic growth and infrastructure facilitation by offering the public an opportunity to invest in bond debentures. Understanding debt capital markets is crucial to comprehend their role in reshaping the contemporary market finance architecture.

The Structure and Participants in Debt Capital Markets

The debt capital markets (DCM) are a fundamental component of the global financial system. They explicitly aim to enhance structured issuance and trading. Some markets act as middlemen between issuers seeking funds and investors seeking stable returns.

Critical Participants in Debt Capital Markets:

-

Issuers are institutions, such as companies and state and local governments, that float debt securities to support their activities, invest in capital projects, or reimburse existing facilities.

-

Investors: The DCM is more prevalent among large corporations and issuers, including institutions such as pension funds, insurance companies, and asset management companies. Individual investors also trade, but to a lesser extent.

-

Intermediaries: Credit departments of investment banks and financial consultants are critical in determining the form, cost, sales, and marketing of debt securities.

Market Segments:

-

Primary Market: Where new debt instruments are created and distributed to investors in the economy. This is the market for the initial capital raising.

-

Secondary Market: Serves to facilitate trading in debt securities where investors can purchase and sell securities.

These participants coordinate abundantly in DCM to facilitate adequate capital at the micro-level. Debt capital markets help support sustainable long-term funding, promote economic stability and development, and satisfy user needs.

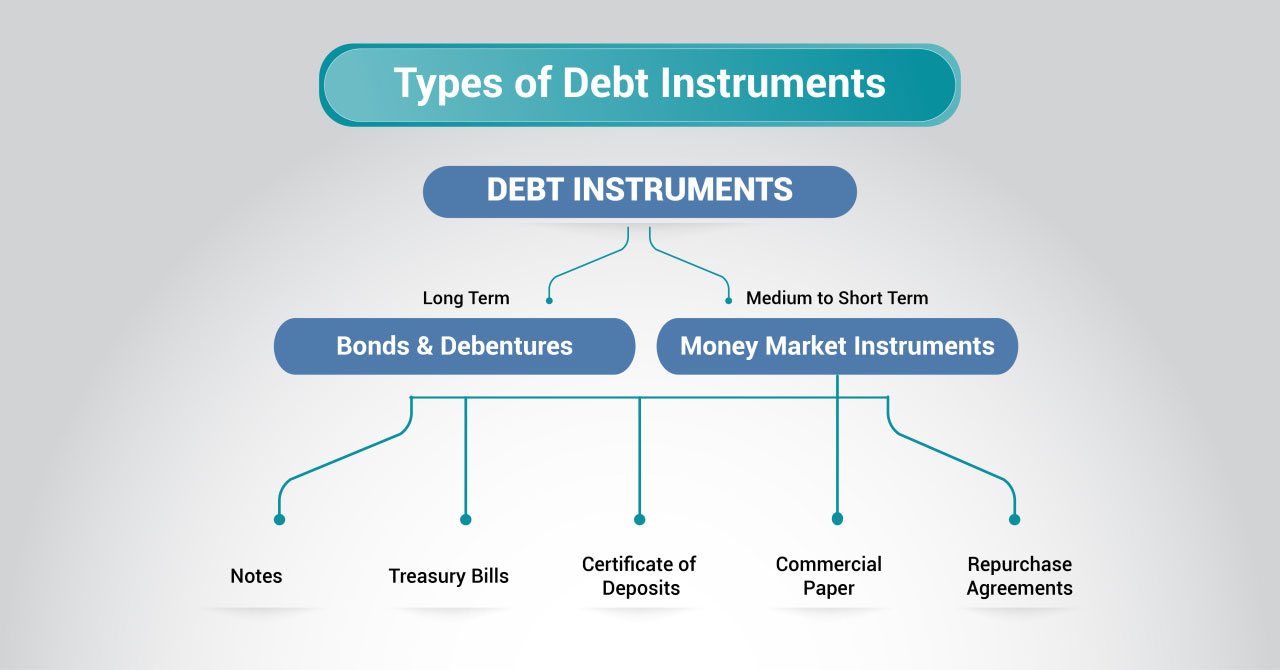

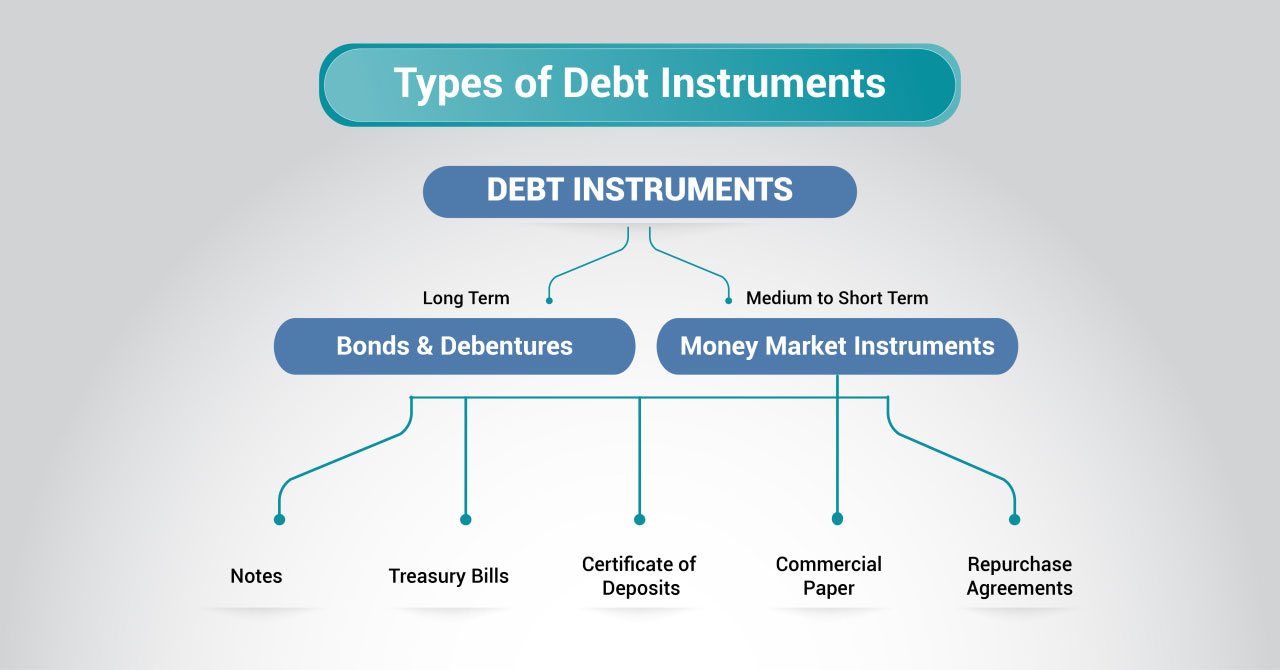

Types of Debt Instruments

Debt instruments are widely used in investment banking debt capital markets since they offer flexible solutions for debt issuers and buyers. Such instruments differ in structure and risk levels and, most importantly, their reasons for existence. Below is a breakdown of the major types:

-

Government Bonds: Government securities floated in the market to raise funds for governmental and local administration’s infrastructure projects or undertakings. They generally are less profitable for the same reason of being highly creditworthy.

-

Corporate Bonds: Issued by companies to raise capital for expansion or operations. Owing to the element of risk attached, these bonds generally yield higher returns than government bonds.

-

Debentures: A liability security that is not supported by a tangible form of asset. Like many securities, debenture holders depend on the reputation and creditworthiness of the issuer company.

-

Treasury Bills (T-Bills): A paper form of debt securities with a maturity period of up to one year, which is available for trading in the market by the government. They are cheaper and are bought, and sold at a premium higher than their face value.

-

Commercial Papers: Temporary debt securities without collateral offered by companies to obtain money quickly for specific purposes. They usually take 270 days before they mature.

-

Certificates of Deposit (CDs): Savings deposits provided by banks with a fixed rate of interest and a specific term on which they are to be renewed. They can afford a relatively safer product for investment, although it is especially suitable for short- to medium-term investment periods.

-

Municipal Bonds: Issued by local government agencies to finance public endeavors, mainly the construction of infrastructure projects. These entities usually issue tax-exempt interest revenue to their investors.

The Role of Debt Capital Markets in Investment Banking

Debt capital markets (DCM) are integral to the framework of investment banking because they offer corporations, governments, and others the opportunity to fund themselves through debt securities. The debt capital market is instrumental in funding long-term planning purposes and formalizing strategies ranging from modern construction plans to contending for strategic acquisitions.

Critical Functions of DCM in Investment Banking:

-

Raising Capital: DCM teams also help issuers develop bonds, debentures, or other securities to raise capital.

-

Structuring and Pricing: Based on market research, investment banks identify the best price conditions, maturities, and coupon rates suitable for the issuers’ needs.

-

Distribution of Debt Securities: It efficiently sells and distributes securities through its large networks to individual investors, institutions, and wealthy individuals.

Strategic Roles:

-

Mergers and Acquisitions (M&A): DCM compliments M&A by offering leveraged financing, which means that the amount of cash required to complete large deals is realized through the debt market.

-

Refinancing Debt: Banks help discharge existing liabilities by restructuring loans and providing better terms. This results in lower out-of-pocket expenses and better operational cash flows for clients.

-

Balance Sheet Optimization: When structuring debt, investment banks assist clients in determining the proper debt-to-equity ratio to optimize their financial health and that of shareholders.

Emerging Trends in Debt Capital Markets

Debt capital markets are in the midst of a transition, and this is due to technological changes and the need for sustainable finance. These shifts are transforming various aspects of borrowing tools and debts, such as issuance, trading, and management processes, hence opening and posing specific issues for industry stakeholders. Below are some of the most significant trends and innovations:

-

Digitization and Automation: Technology continues integrating into bond issuance, cutting costs and increasing efficiency. Sophisticated trading technologies lead to faster deal processing, improving market openness for sellers and buyers.

-

ESG Debt Instruments: The recent emergence of green and sustainability-linked bonds is driving increased investor interest in ESG. These instruments encourage corporations to embrace more sustainable activities while allowing investors to fulfill ethical investment requirements.

-

Blockchain and Tokenization: Blockchain technology brings transparency and security to the debt market. Security tokens are gradually becoming one of the new forms of fractional ownership, expanding the base of potential investors and increasing the turnover of transactions.

Regulatory Landscape in Debt Capital Markets

The regulatory framework in debt capital markets is pivotal in ensuring transparency, protecting investors, and maintaining market stability. These regulations are harmonized at the regional level to enhance market efficiency and prevent systemic threats. Regulatory agencies regulate the issuance, trading, and reporting of debts under specific rules to prevent financial malpractice.

Key Aspects of DCM Regulations:

-

Credit Rating Oversight: Credit rating agencies are also regulated to ensure the accuracy of the rating standing.

-

Capital Requirements: Both issuers and intermediaries must conform to capital adequacy measures set to prevent market failure.

-

Market Conduct Rules: Laws require ethical trading behavior and sanction unlawful behavior, such as insider trading or manipulation.

-

Risk Mitigation: Frameworks require reporting on debt instruments, and since they do not restrict the disclosure of accounting risks associated with these instruments, investors can effectively evaluate the risks.

The future of debt markets is defined by changes in the current legislation, for example, in climate risks and compliance with the standards of ESG. When rules are implemented, investors' standing improves. At the same time, issuers are pressured due to the need to meet compliance costs and backbreaking operations, not forgetting the need to work under the new rules formulated.

Strategic Insights for Leveraging Debt Capital Markets

Debt capital markets investment banking involves matching strategic issuers and investors to plan and manage debt capital markets efficiently. This entails recognizing marketplace trends, acquiring the best funding strategies, and considering long-term financial objectives.

For Issuers:

-

Timing the Market: The macroeconomic factors, including changes in interest rates, should be observed to determine the appropriate time for an issuer to launch a debt offering.

-

Diversifying Funding Sources: Relying on multiple instruments, including short-term and long-term debt, minimizes refinancing risks and enhances liquidity.

-

Maintaining Creditworthiness: The implication is that a high credit rating puts a business on better bargaining ground and hence saves on interest rates on loans. Issuers should pay particular attention to their sound financial management to retain or enhance their rating.

For Investors:

-

Risk Assessment: Potential investors are encouraged to research and acquire satisfactory information about the issuers to facilitate credit risk and macroeconomic risk analysis.

-

Portfolio Diversification: Diversification of investments by sectors, geographical locations, and credit ratings can help reduce market risk.

-

Yield Maximization: The skillful combination of high-risk bonds with high-return potential for investment-grade bonds allows for the highest effective yield without significant fluctuations in a portfolio’s stability.

Conclusion

Debt capital markets are a critical component for growth, given the vital value they bring in facilitating capital raising for governments and business entities. Through various means of operations, innovative positioning, and strict legal compliance, they guarantee stability and liquidation in the global financial markets. ESG strategies and innovation have remained the key drivers of change as we design debt capital markets investment banking as a central component of sustainable and innovative financial solutions in a dynamic economy.