Most corporate name changes are the result of mergers and acquisitions. But these tend to be unimaginative.

- James Surowiecki

Mergers and Acquisitions (M&A) are usually high-value and greater stakes transactions with a lot present. The process of M&A is intensive. The process will alter based on the size, complexity, and kind of M&A deal. The words "mergers" and "acquisitions" are usually interchangeable, but they vary in meaning. They refer to the consolidation of organizations or their high business assets with financial transactions among the organizations. An organization will buy and absorb another organization outright, merge with it into making a new firm, acquire a few or all of its major assets, give a tender offer for its stock, or create a hostile takeover. All of these fall under M&A activities.

The role of investment bankers in cracking the M&A deals is to suggest other firms and execute the transactions where the business owners keep on selling their business to buyers, obtain smaller targets, and divest or get certain divisions or assets from other firms. They execute sell-side and buy-side deals of M&A.

In other terms, investment banking (IB) is the industry that fuels the engines of M&A. The merger of two or more firms via M&A is a process, which is quite complicated as there are a lot of areas that are moving. It demands certain expertise in fields like valuations, capital raising, communication with investors, deal negotiations, and many more.

Investment banking professionals make sure to gain enough specialization in all of these fields, enabling them to act as intermediaries for firms that want to get or merge with other firms.

The US investment banking industry is estimated to be the home to around 3,000 firms, earning about $140 billion. It is massive and has a great role in the biggest transactions that take place across every other industry.

M&A is the main subset of IB. Where most of the 3,000 investment banks in the US function with M&A process and capital raising. However, the investment banks offer a diversified service scope, which consists of:

The M&A process possess the ability to reshape firms and their industries like no other corporate action. In any M&A process, obtaining the right timelines is very essential. Larger deals may not mean more time but might require more resources.

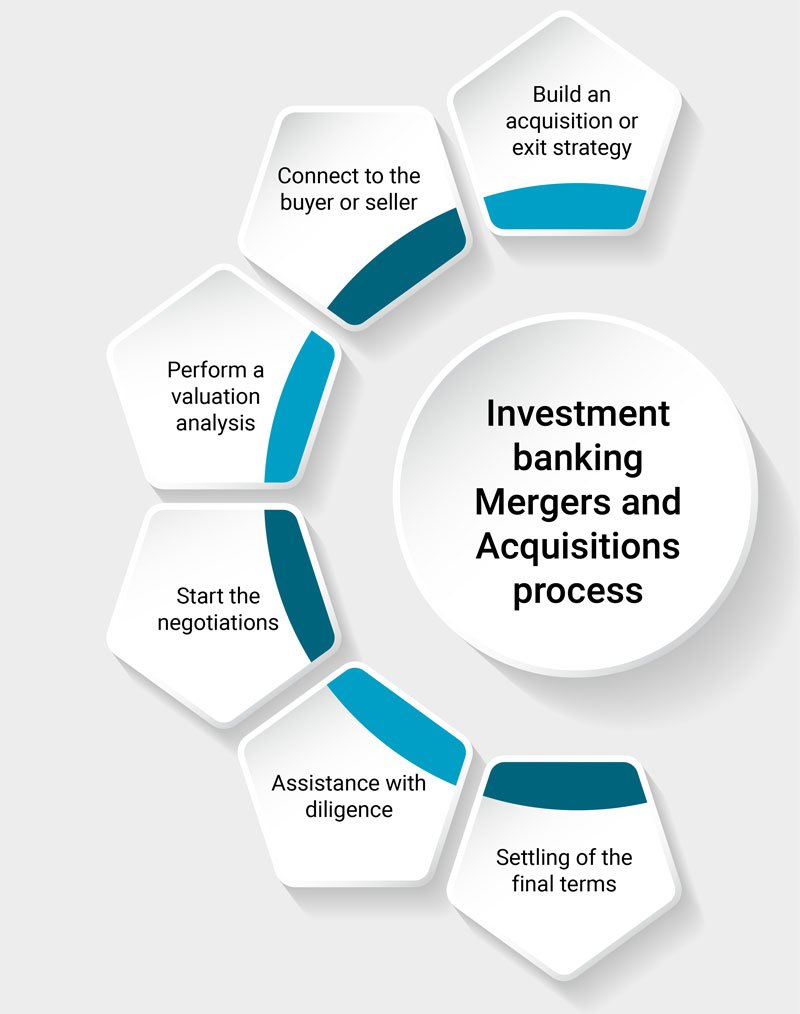

Let's have a closer look at the M&A process from the investment bankers perspective:

Based on the previous section we can clearly understand that investment bankers make sure that the deals happen. The top leaders of any organization often have at least a shortlist of organizations that interest them.

However, to convert them into deals, they are required to hire professionals, who are keen to grow in their investment banking career that have a cerctain set of skillsets needed for cracking the deals. This gives them to get the maximum value from the work they perform as part of their mandate from the organization.

The roles professionals take for M & A investment banking are too many. Some of them are:

Investment banking is the perfect career choice for professionals who are seeking a growing job profile and the benefits that come along with it, such as compensation. With so high financial rewards, it is not a surprise that careers in IB are the most coveted of all jobs. A professional often spends between 2 to over 5 years as an analyst, sometimes earning close to USD 200,000.

Salaries are one of the top post-MBA career options, in the US, the average starting base salary for analysts is between USD 75,000 to USD 96,000 per annum. If one considers other perks like bonuses, signing, and stub bonus earnings, these can be around USD 150,000 or more, also for first-year analysts.

Apart from, great salaries and bonuses, an investment banking career also offers perks like vacation, health insurance, profit-sharing, and retirement packages.

Entry-level analysts in IB often take care of excel and PowerPoint work, track buying and selling, handle the documentation, and correspond with clients. The progression of the career from an analyst to a managing director often takes more than 12 years.

The table below gives the career progression in the IB industry if an individual passes all the standards by excelling in their performance.

| From | To | Average Period |

|---|---|---|

| Analyst | Associate | Associate |

| Associate (typically MBA) | Vice President | 3 years |

| Vice President | Senior Vice President | 3-4 years |

| Senior Vice President | Managing Director | 2-3 years |

However, USA and UK are housing the top banking companies like JPMorgan Chase, Goldman Sachs, Citi, Wells Fargo, Bank of America, and more, which pay the highest salaries in the industry. Others like India and Canada consist of a smaller industry and pay lesser than the USA and UK.

The least preparation period of any M&A transaction is 2 to 3 months if there are no substantial alterations to the sell-side business or its reporting structure. If there are then both internal and external advisors may require 6 months or longer for deal preparation. Once the deal moves, the IB plays an active role in the negotiation of the terms of the deal.