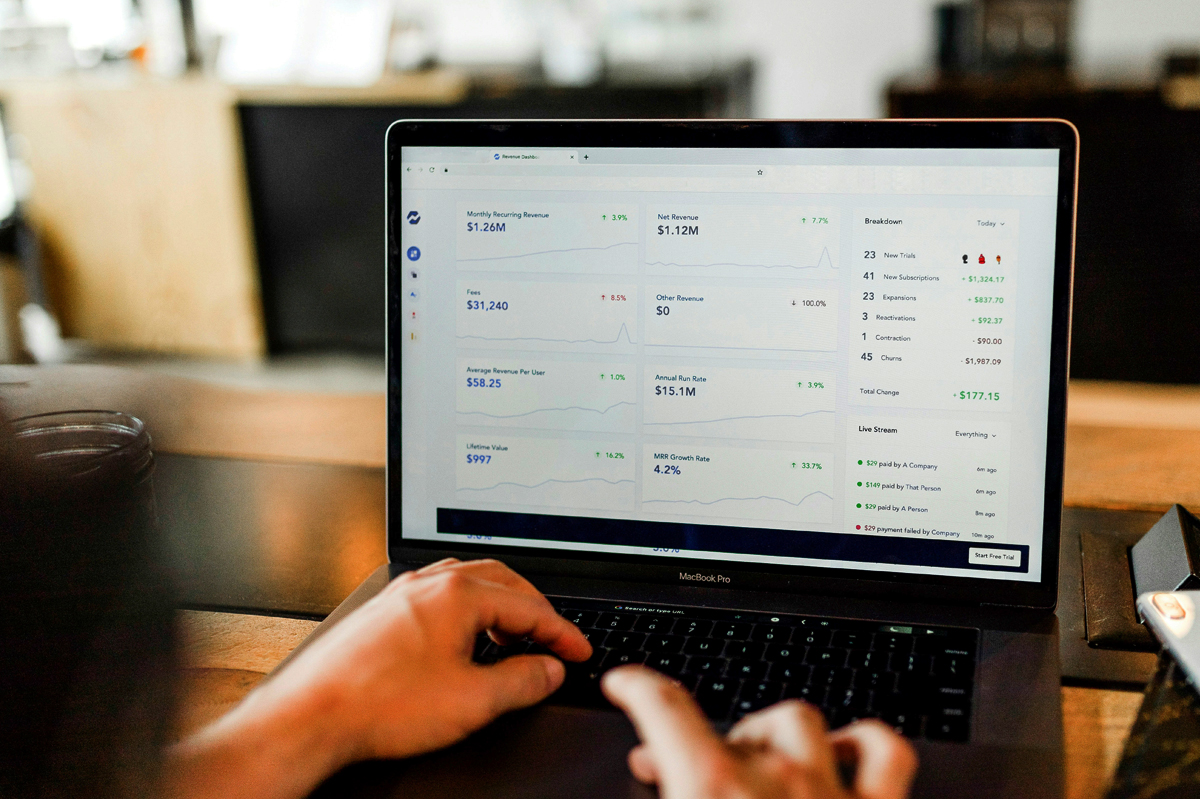

The financial models are the origin of decision-making, in the dynamic investment banking industry. They not only serve as analytical tools, but also, through an assessment of the financial performance of the company, the identification of risks, and the formulation of its strategic planning. As is the case with more and more sophisticated financial needs, the role of accuracy and reliability of financial projections is becoming crucial, and financial models are rightfully considered the major tool for this role.

Financial models can predict trends and advise companies on each decision-making criterion and, therefore, support a good investment decision. This article provides an overview of different models of finance adopted in the investment banking sphere wherein the importance and scope are underlined to make informed and intelligent financial decisions.

Financial models enhance the measures of analysis, prediction, and intelligence processes in investment banking for investment, merger, and acquisition transactions. These models are very useful for making financial analyses of various projects and assessing both the risks and the returns of them. This part will focus on the range of financial models that we can find in the general investment banking industry.

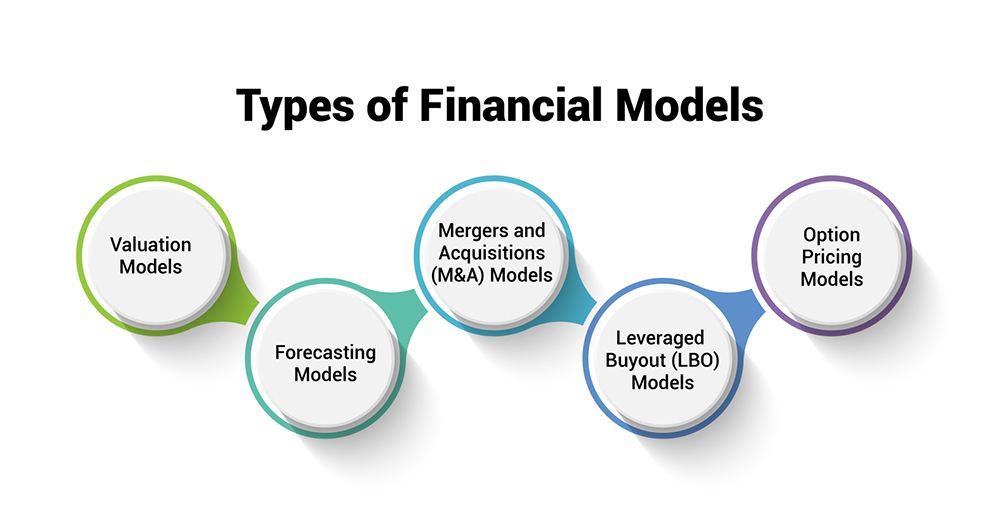

Valuation models are applied to find the fundamental value of assets, and companies, or else investors can employ them to investigate possible opportunities. The common valuation techniques include discounted cash flow (DCF), comparable company analysis (CCA), and previous transaction methods. DCF evaluation means figuring out the existing worth of revenues produced by an asset or company in the present, considering the time value of money. The CCA process requires contrasting the financial indicators of the target company with those of similar companies from the same sector to determine its fair market value. Precedent transactions analysis (PTA) involves studying the fiscal terms of past mergers and acquisitions in the same industry to establish the valuation multiples.

Example: Suppose an investment banker is given the job of valuing a manufacturing company, she first needs to analyze the current market condition and decide if the company is in a position to take advantage of a favorable market. While DCF analysis is used, the banker estimates how much cash the company is likely to generate over the next five years and then discounts this cash flow back to its present value by using a suitable discount rate. The discount rate has its effect on the resulting present value which represents the estimated intrinsic value of the manufacturing firm.

Forecasting models are built upon historical and assumptions-based data about future market conditions to project future financial performance. The average prediction methods include regression analysis, time series analysis, and scenario analysis. Time series analysis implies researching historical data to trace any patterns that will help to define what can be expected in the future. Regression research consists of revealing the interdependence among the variables to predict the outcomes from the future. Scenario analysis can be seen as a process of developing and deriving different scenarios before selecting the ones that have the largest impact on a company’s financial statistics.

Example: Forecasting Sales by Making Use of a Moving Average

A local bakery would like to anticipate daily bread sales to avoid over-baking or under-stocking. The simplest forecasting model, the moving average, can be utilized here. Here's how it works:

The merger and acquisitions models are the tools that are being used for evaluating the financial effects of the mergers or acquisitions that can take place. These models can be implemented by the accretion-dilution technique, and the prediction analysis after the merger becomes the next step. The accretion/dilution analysis is undertaken by computing the company's EPS before and post-acquisition to ascertain whether the transaction increases or reduces EPS. The merger effects analysis is majorly focused on the study of the financial outcome after the merger on main financial metrics like cash flow, profitability, return on investment, and other most important things.

Example: M&A Model Example: Coffee Shop Acquisition

Suppose a large coffee chain (Acquirer) is planning to acquire a small coffee roaster with a specialty coffee (Target). An M&A model would analyze this by:

LBO models (leveraged buyout model) are used in the assessment of the financial viability of leveraged buyout transactions that involve the acquisition of a company with a large amount of debt. The debt structure will occur alongside structuring the cash flow of the target company and the return on investment for the acquirer. A core component of LBO models involves debt structure research, planning of cash flow estimates, and exit strategy.

Example: LBO Model in Action

Consider buying the company with a credit card (debt converter) instead of cash. An LBO model puts an investor in the place to know whether this investment is a good deal or not. It is a forecast of future finance, accounting for both debt payments and the income that the business can generate in repaying these debts. The investor can use this model to evaluate the investment accordingly for the right portion of the deal equity in place of what it would have in his asset.

Option pricing models have applications to the pricing of financial derivatives like options and futures contracts. The majority of option pricing models are represented by Black-Scholes as well as binomial options pricing models. These models incorporate the present price of the underlying asset, the strike price, the time-to-the-board line, and the volatility of the underlying asset, to find the fair price of the option.

Example: Suppose, you have purchased a new video game for USD 40 (strike price) while the present market price is highly volatile. The option pricing model is the highly calculated algorithm that will consider the current price, the possible changes in price, the time to the coupon expiry (time value), and any unforeseen changes in the market (volatility). It is the way to determine what the coupon is worth (premium) at the present. This means that you can decide to buy the discounted coupon now or wait, depending on the expected main game's price in the future, and achieve the best deal.

Financial models are paramount in various aspects of the investment banking sector, helping the bankers obtain the right and more informed decisions and advancing the clients.

Valuation: Financial modeling widely applied in investment banks, is accustomed for assessing purposes. The analysts use models like discounted cash flow (DCF) and comparable company analysis (CCA) to find out the intrinsic value of a company or any asset at a particular period. These models can be useful for investment bankers who could recommend clients about potential mergers, acquisitions, investments, etc. The models act like a comprehensive valuation analysis to show the best options for clients.

Risk Assessment: The financial models are a top-notch tool that is used for assessing risk in the investment banking environment. Indices like the value at risk (VaR) model and stress testing models are the tools used for market fluctuations and crisis events' influence on investment portfolios. This is twofold because incorporating risk factors helps bankers to evaluate such risk factors and in turn make necessary decisions that enable them to manage risks.

Financial Planning: Investment bankers use financial models to project cash flows for long-term financial planning. Models help in maximizing potential results by monitoring performance which was projected on different scenarios. It also offers bankers the chance to characterize the strategic plans and investment strategies that accord with the financial requirements of the clients.

Mergers and Acquisitions (M&A): The financial model serves as one of the most important tools in the process of mergers and acquisitions. For example, in the cases of mergers and acquisitions modeling tools, such as merger consequences analysis and accretion or dilution analysis are used to evaluate the financial consequences of such transactions. Such models are for the aim of discovering the target company value as well as the synergy effect that may be there.

As the investment banking industry continues to evolve, several emerging trends and innovations are reshaping the landscape of financial modeling.

Integration of Artificial Intelligence (AI): AI in investment banking has greatly revolutionized financial modeling through its data-driven and predictive capabilities. Machine learning algorithms can discover devastatingly complicated patterns from financial data to enhance the accuracy of the models.

Big Data Analytics: With the wider adoption of the data, in combining an increasing number of varieties of financial data, advanced analytics are being required Banking investment organizations can deal with incredibly large amounts of data using big data technology fast enough, on top of which decision-makers make their choices with more confidence.

Quantitative Finance Techniques: Investment banking is progressively applying computationally-powered techniques to craft complex systems. Techniques like stochastic calculus and Monte Carlo simulations are applied to understand the behavior of complex financial instruments and markets.

Blockchain Technology: Removal of middlemen will be facilitated by integrating blockchain technology into settling processes, the result being that the process is simplified. As a result, the development of smart contacts based on blockchain technology ensures the implementation of some financial transactions that have a direct influence on the structure of financial modeling procedures.

Financial models are the vital tools with which the investment banking industry cannot function properly, since they provide investors and managers with clarity for their decisions and strategic planning. Their expertise is one of the key managers to such models as valuation, forecasting, and M&A to evaluate the level of risks, evaluate the opportunities, and optimize financial outcomes.

However, despite their significance, financial models have their challenges and limitations; therefore, designing them based on good practices and making revisions should never be taken for granted. There is a huge prospect in the advancement of technology in that it is prudent for investment bankers to fully embrace AI, and machine learning for faster and more effective financial modeling. Merging these advancements will be the basis of staying among the competitors for survival and success. Purposeful change is the way to the future in an ever-changing financial environment.