With a slew of features like a discount for early investors or for those who lock up their capital, a minimum return level, or the 1-or-30 model, investors look for more defensive strategies with predictable return profiles. IBCA discusses the challenges fund managers face and how they can renew their strategies.

A repeated read aloud statement that persists in the hedge funds community is that they are opportunistic predators or a group of overpaid underperformers. The hedge fund community often carry this reputation, despite the endeavors to rebuild their status in the industry. Given the COVID-19 situation, this cold approach that hedge funds once had is changing drastically.

Though the investors could not entirely escape the chaos, hedge funds have fared better amid the current crisis. At the mid-point of the year 2020, hedge funds have outperformed the stock market. Barclays' strategic consulting team suggests that there is a momentum building this year, setting the scene for a new opportunity for investors. The survey further confirms that investors intend to increase their allocations from a marginal net positive to 25% net positive - a big shift in investor sentiment.

While all these sounds to be some good news, there exists plenty of challenges for the fund managers in the current environment. The hedge fund managers must keep their heads-up and expect the unexpected to survive and thrive in the environment.

Take a look at the challenges and their possible solutions here.

The main challenges faced by hedge fund managers include operations management, investment risks, underperformance, fee structures, and technology adoption. These could form the reasons for hedge funds failure.

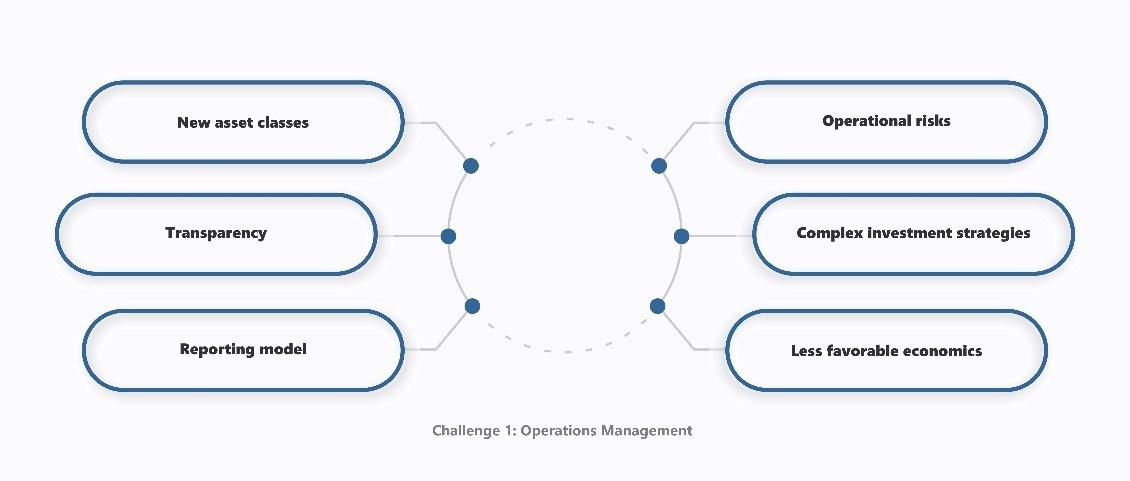

Many hedge fund officers find difficulty in –

Supporting current trading strategies

Introducing new asset classes

Delivering transparency for clients and regulators

Reporting model to satisfy regulators and clients

Minimizing operational risks through a seamless connection between front, middle, and back-offices

Operating efficiently in terms of people, process, and technology

Understanding the increasingly complex investment strategies

Less favorable economics

These challenges are forcing hedge fund managers to take a hard look at their operations or else, they may put their entire organization at risk.

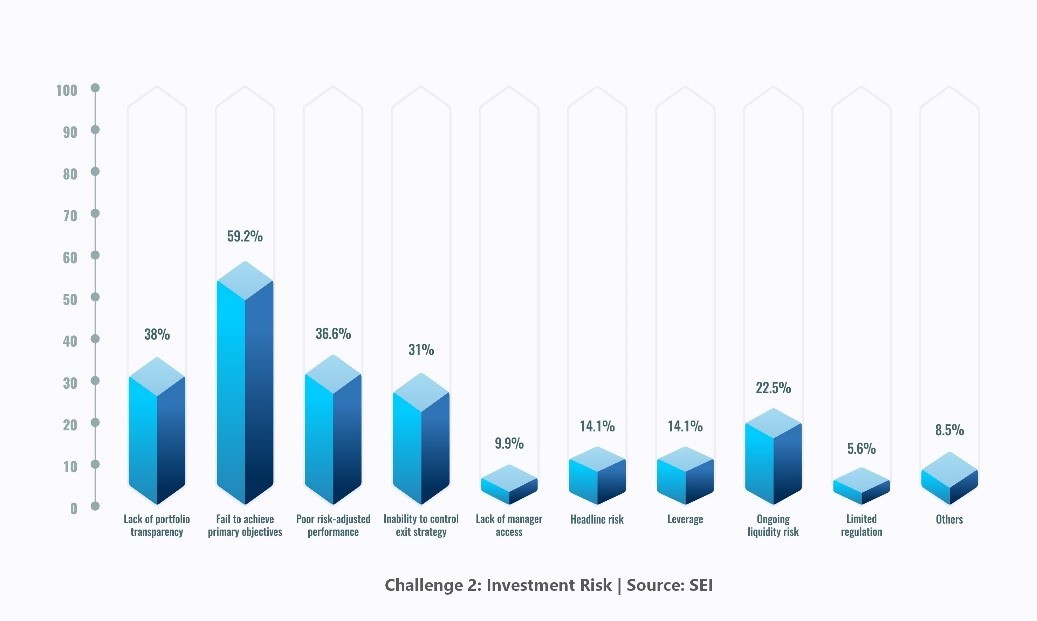

Lack of portfolio transparency is the biggest concern to invest in hedge funds, outranking risk-adjusted performance, SEI hedge fund survey reports. The hedge fund firms that trade on margin run a severe risk when there occurs a change in market behavior. Putting too many clients’ eggs in one industry basket could be disastrous.

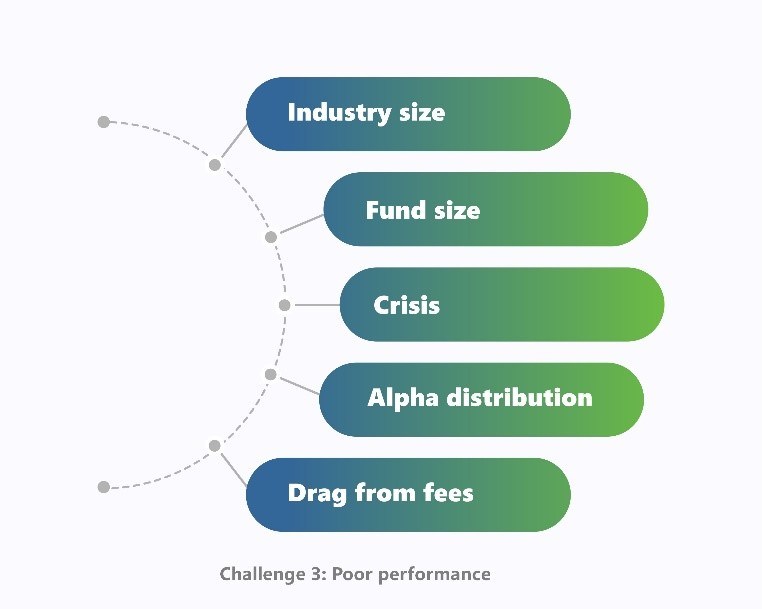

Hedge funds struggle a lot to outperform traditional benchmarks. Records show that hedge funds have underperformed against the S&P 500. This has led to the moving of assets to better-performing managers or leaving the hedge funds altogether.

The main reasons for poor performance can get attributed to the size of the industry and funds, crisis, unsmooth alpha distribution, and drag from fees.

The revenue structure by which hedge fund management fees are derived is the traditional 2-and20-model. Critics say that this traditional fee structure does not provide an appreciable incentive for hedge fund managers. Further, the management fees are falling in recent years as the investors demand fees that correlate to performance and profit.

We find new technologies on the horizon always. It could be big data, Artificial Intelligence, Machine learning, and more. Many firms are building custom platforms for their data management already. Hedge funds must have an integrated and scalable solution hosted that can handle a broad array of asset classes and functions for trading and risk management.

AI hedge funds will gain a competitive edge in the market and may outperform their human counterparts. However, the biggest pitfall in AI adoption is that a pre-trained/general model will never work perfectly. There is an urgent need for additional training on data specific to a business case or use case. In some cases, it may take years to ensure their NLP is fine-tuned for the financial industry. The firms must accommodate timelines to train the model.

Fund managers must concentrate on timing and performance to attract clients. To pass an operational due-diligence review, fund managers must think of the anticipated features, functions, and ability.

Top companies target fund managers who can focus on alpha, possess stable net exposure, proven track record, managing risk during a crisis, and can repeat a proven investment process. A few of the tidbits are:

Invest in a strong operations and compliance team.

Increase investment acumen

Hire the best staff in the industry is crucial.

Maintain a level of liquid assets.

Gain transparency with investors and governing bodies.

Stay upfront about conflicts of interest.

Spend time on investment research.

Identify trends and opportunities.

Looking ahead, the hedge fund industry is optimistic about returns over the next year. The signals so far also indicate the same.

What do you say?