In the Financial ecosystem, a fast-tracked change could mean the utmost creation or lethal destruction. Could this be the reason why:

81% of banking CEOs are at unease with the speed of technological change. – PwC 2016 survey.

Their concerns seem to be rooted in the history of technology advancements.

The earliest technologies forked out their footing in the 1800s. However, it was only during the 2000s that mass-market adoption of technologies compounded at an unprecedented rate. Think of these few developments to get a picture of this riot:

The 1870s birthed the first telephone, which took additional 75+ years to reach 50% of the US market. Come down to the 1980’s, think of the internet’s birth, taking 25+ years to gain global reach.

1992’s invention, the first smartphone, was absorbed in the global mass-market in a terse span of 10 years. Tablet, introduced in 2010, gained 50% adoption in five years.

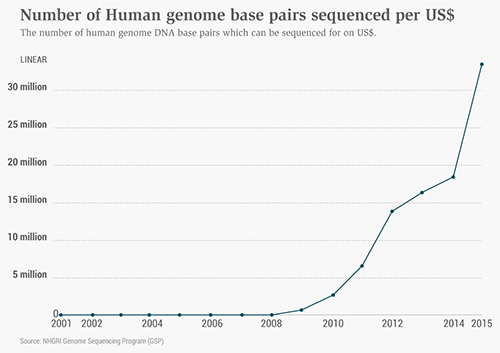

Take a look at the development in the number of human-genome base pairs in the recent few years:

Note the speed and the scale of these changes, which has been unprecedentedly massive and deep-seated.

After upending businesses in almost every other industry, technological advancements are now headed toward the financial sector as FinTech becomes increasingly popular.

Here are six prominent trends shaping this diversion.

For a long time, legacy and large-scale financial behemoths reveled in their monopoly over the financial services industry. They seemed to have it all: foolproof compliance systems, loyal clients and abundant resources. This power is melting away.

28% of Banking and Payments and 22% of Insurance, Asset Management and Wealth Management business are at risk – PwC, 2016 survey

These long-established institutions are being challenged by innovative and fast-moving start-ups. USD 40 billion were invested in FinTech in 2018. In the first half (H1) of 2019, USD 37.9 billion were invested in these start-ups. As we wait for the final figures of 2019, we are more than assured of it passing its previous year’s mark probably by double digits.

But why these disruptors are earning investors’ trust? Because they offer:

Sharing-economy has changed the business landscape in cars, room rentals, food, and many other industries. Successfully so. Now, its financial services industry’s turn to profit from them.

Two prime sharing models are on the horizon: decentralized ownership of assets and matching and linking users and providers of capital.

Use case: Apple has requested a patent for “person-to-person payments using electronic devices.” This service will allow iPhone users to send and receive money.

In Kenya, M-PESA uses customers’ phones and a network of agents to handle its deposits and payments. The service is currently being used by 90% of the adults in the country.

In 2019, 13 blockchain companies availed USD 365 million in funding. The trending is permeating at an unpreceded rate.

By 2020, 77% of financial services institutions are planning to use blockchain for their operations - PwC

Use case: Fast, safe and low-cost digital wallets are giving tough competition to the financial institutions. 50% of millennials say they would prefer wallets over cash.

The rise of social media has fortified connections and reduced customer loyalty. Customers, who have become accustomed to the speed and ease of e-commerce, now expect the same kind of services from financial institutions.

One out of three millennials say they can switch their banks in the coming three months - Viacom Media Networks

A similar number of millennials also believe that they might not need banks in the future. Few other responses indicate that customers are not keen on buying umbrella solutions (mortgage, insurance policy or investment plans that cater to universal needs). Instead, they prefer tailored and flexible solutions with desired outcomes.

Financial institutions are flooded with data. In days ahead, manual analysis of this data will become impossible. Banks are already using artificial intelligence for fraud detection. Banks will increasingly use AI to detect unusual customer behavior and to identify market misuse and fraud trading. Leading Global banks are experimenting with AI-based cognitive virtual agents to answer queries and come up with recommendations for consumers.

Gartner says the public cloud market is expected to reach USD 266 Billion in 2020. Cloud has greatly cut the barriers for FinTech disruptors and now even garage startups can use big data and analytics and compete with the long-established blue-chip players.

70% of financial services organizations are adopting Cloud - InformationAge

International Data Corporation (IDC) says public and private cloud investments are proliferating, and investments in traditional infrastructure have slumped.

Technology is not a question of an upgrade now; it is a question of survival. To cope up with the disruption tsunami, Investment Banking Organizations must carve a technology plan. Here’s what we suggest:

Pick your call - Whether you want to lead, follow or respond. And follow through.